- #LONG TERM CAPITAL GAINS TAX BRACKETS 2020 HOW TO#

- #LONG TERM CAPITAL GAINS TAX BRACKETS 2020 PROFESSIONAL#

Consult IRS Publication 523 if you are disabled, in the military, Foreign Service, or intelligence community for tax breaks. You did not live in the house for at least two years before selling it in the five-year period preceding the sale. You owned the property for less than two years out of the five years before selling it. You didn’t live in the house as your primary residence. Generally, if any of the following conditions are met, you must pay tax on the entire gain from the sale of a home.

#LONG TERM CAPITAL GAINS TAX BRACKETS 2020 PROFESSIONAL#

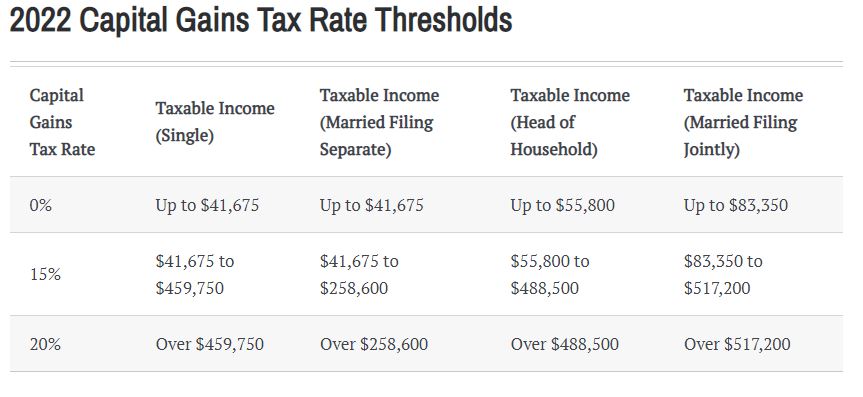

Each of these situations may open up complex tax questions, so again be sure to consult with a professional before filing. Other circumstances include properties that are the seller’s primary residence, if the property was recently acquired through a 1031 exchange, or if the seller pays expatriate taxes. For example, if you have used the capital gains exclusion on a home sale within the last two years you may not qualify for the exclusion. In these cases, capital gains taxes are often unavoidable, though you should always speak with a tax planning advisor to confirm. There are certain circumstances where a home sale may be fully taxable. When Do You Pay Capital Gains Tax On A Home? This is why it is advisable to hold an investment longer than a year so that you can take advantage of lower long-term capital gains tax rates.” We’ll explore short-term and long-term capital gains tax rates a bit further later on in the article. On the other hand, short-term gains (assets held less than a year) are taxed on ordinary income rates and can go as high as 34%, depending on the income level. The cost of owning the property, including any fees paidĪccording to Nate Tsang, the Founder and CEO of Wall Street Zen, “tax on a long-term capital gain in 2021 is 0%, 15%, or 20% based on the investor’s taxable income and filing status, excluding any state or local taxes on capital gains. Within the context of real estate, if you were to sell a property, the capital gains tax you would owe depends on three main factors:ĭuration of time in which the property was owned The tax rate for these capital gains isn’t an umbrella percentage but is based on numerous factors that affect the percentage of taxable gain. Now that we understand what capital gains tax is, let’s explore how much capital gains taxes typically are so that taxpayers can properly anticipate any payments that will need to be made. How Much Is A Capital Gains Tax On Real Estate? It can also apply to a car, boat, or even rare piece of artwork that is sold for more than it was initially purchased. Capital gain can be applied for more than just real estate gains. Generally, it’s rare to sell an asset for more than it was purchased for due to depreciation, but if an individual does sell their asset for more than they acquired it, the asset would then be classified as a capital gain. Therefore, you may not be taxed on capital gains if you sell a property for less than you bought it for. To clarify, capital gains are only realized when an asset is sold for more than it is purchased. The name says it all: capital gains tax on real estate simply refers to the tax levied on any gains made from a real estate sale. The difference between what you paid for an asset or property and what you sell it for is what the IRS uses to assess capital gains tax. What Is Capital Gains Tax On Real Estate?Ī capital gains tax on real estate is a fee levied on profits made from the sale of a property.Ĭapital gains taxes can be applied to both securities (such as stocks and bonds) and as well as real estate and other tangible assets. With FortuneBuilders’ helpful guide, real estate investors and property owners can feel confident heading into the tax season.

#LONG TERM CAPITAL GAINS TAX BRACKETS 2020 HOW TO#

long-term capital gain tax rate, as well as how to avoid capital gains tax as much as possible if you believe your assets will be subjected to it. In this article, we will explore the real estate capital gains tax, short-term vs.

While understanding capital gains tax on real estate may seem overwhelming at times, having a firm grasp of capital gains and respective tax requirements ensures that investors and property owners can properly benefit from their investments and be squared away with the IRS.

This is especially true if you recently sold, or plan to sell, your property, which is when capital gains tax goes into effect. The capital gains tax on real estate investment property is something you want to be familiar with if you own any real estate, whether it’s your home or another type of investment property. It’s tax season, and it’s to your advantage to know about the taxes and deductions that apply to you. How much is capital gains tax on real estate?

0 kommentar(er)

0 kommentar(er)